Published on: March 26, 2025

Introduction

The rapid evolution of technology in the past few decades has redefined business operations and the way organizations connect with customers, employees, and stakeholders. Among the various sectors undergoing digital transformation, banking stands out as one of the most impacted. Digital banking is not merely about shifting traditional banking services online but represents a comprehensive shift in how financial institutions deliver their services, interact with customers, and innovate. This transformation has far-reaching implications not only for the banking industry but also for the organizational culture, learning practices, and performance of employees.

In this journal, we delve into the key aspects of digital transformation in the financial sector, focusing on digital banking and the emergence of digital culture. We further explore the importance of organizational learning in adapting to rapid technological change, how innovation is becoming the lifeblood of competitive advantage, and how all these factors contribute to enhanced employee performance. Through detailed analysis and case studies, the article provides insights for leaders, managers, and professionals aiming to thrive in this new era of digital business.

The discussion is organized into several sections. First, we explore digital banking, its evolution, and the benefits and challenges it presents. Following that, the concept of digital culture is examined, highlighting how a modern, tech-savvy mindset is essential for sustaining innovation. We then transition into organizational learning, which is crucial for any company seeking to remain competitive. The role of innovation, as both a process and a mindset, is explored in depth, and finally, we discuss how all these elements impact employee performance and engagement.

With the integration of advanced technologies such as artificial intelligence, machine learning, and blockchain, digital banking is revolutionizing the financial services industry. At the same time, the transformation demands an equally robust evolution in the internal culture of organizations. Building a digital culture requires companies to embrace change, encourage creative problem solving, and invest in continuous learning initiatives. For employees, the promise of a digitally enabled environment is not just about improved tools, but also about new opportunities for professional growth, skill enhancement, and better work-life balance.

This comprehensive journal aims to bridge the gap between theoretical concepts and practical applications, offering valuable insights that can be implemented by organizations at various stages of their digital journey. Whether you are a banking professional, a technology enthusiast, or a business leader, the contents of this article will provide you with a deeper understanding of the interplay between digital banking, digital culture, organizational learning, innovation, and employee performance.

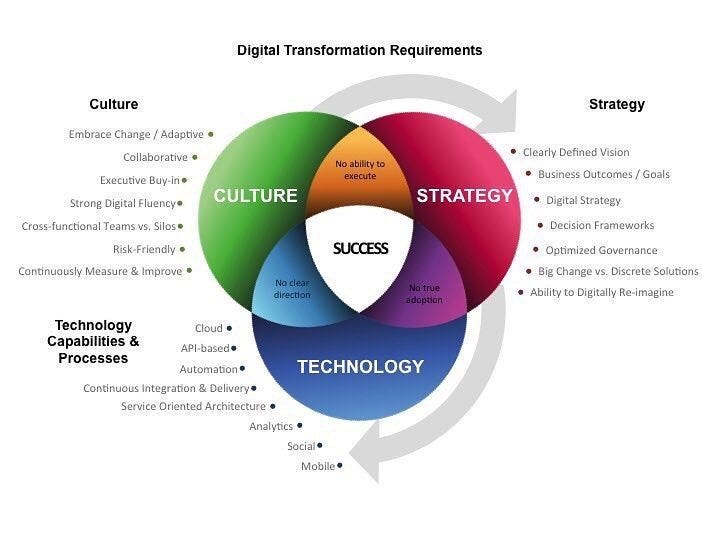

Figure 1: Digital transformation in banking serves as a foundation for innovation and improved customer experiences.

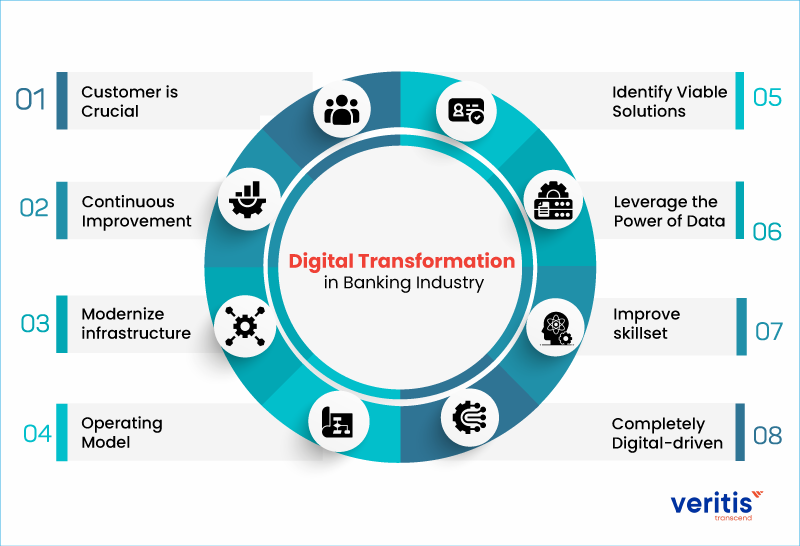

Digital Banking: Evolution and Impact

Digital banking represents a seismic shift in the way financial services are delivered. Unlike traditional banking, which relies heavily on physical branches and face-to-face interactions, digital banking harnesses the power of technology to provide convenient, secure, and efficient financial services online. With the advent of mobile banking apps, online account management, and real-time transaction processing, customers are now able to access banking services anytime and anywhere.

The evolution of digital banking can be traced back to the early days of the internet when banks first introduced online services. Initially, these services were limited to basic functionalities like checking account balances and transferring funds. However, over time, technological advancements have enabled banks to offer a broader range of services such as loan applications, investment advisory, and personalized financial management tools. This continuous innovation has driven customer expectations to a new level, necessitating further investment in digital infrastructure.

One of the most significant impacts of digital banking is the enhanced customer experience. With intuitive interfaces and seamless navigation, modern banking apps provide a user-friendly experience that traditional brick-and-mortar banks struggle to match. Digital platforms also offer personalized financial insights, automated alerts, and tailored recommendations that empower customers to manage their finances more effectively. Furthermore, the integration of advanced analytics and machine learning algorithms allows banks to predict customer needs and offer proactive solutions.

Despite these advancements, digital banking is not without its challenges. Security remains a critical concern as cyber threats evolve in complexity and frequency. Banks must continuously update their cybersecurity protocols to protect sensitive customer data from breaches and fraud. Additionally, the digital divide continues to be an issue, as not all customers have equal access to the latest technologies or possess the digital literacy required to navigate complex digital systems. Regulatory compliance is another area that requires careful attention, as financial institutions must balance innovation with stringent legal requirements.

To address these challenges, banks are increasingly adopting multi-layered security measures and investing in robust IT infrastructures. Collaborative efforts with technology firms have enabled the development of more secure authentication methods such as biometrics and two-factor authentication. Moreover, educational initiatives are being implemented to help customers improve their digital skills, ensuring that they can safely take advantage of the benefits offered by digital banking.

The transformation of banking services is also influencing the competitive landscape. Fintech startups are challenging traditional banks by offering innovative solutions and agile business models. This competition is driving established banks to accelerate their digital transformation initiatives, adopt customer-centric strategies, and invest in technology partnerships. The result is a dynamic and rapidly evolving ecosystem where collaboration between traditional banks and fintech innovators is becoming more prevalent.

Additionally, digital banking is playing a pivotal role in financial inclusion. By leveraging technology, banks are reaching previously underserved populations, offering them access to financial services that were once out of reach. This democratization of banking has the potential to spur economic growth and foster entrepreneurship in emerging markets.

As digital banking continues to evolve, its integration with other technological advancements such as blockchain, artificial intelligence, and big data analytics will further redefine the financial landscape. These technologies promise to enhance transparency, improve operational efficiency, and deliver personalized services that cater to the unique needs of every customer.

In conclusion, digital banking is not just a trend but a fundamental transformation that is reshaping the entire financial services industry. Its evolution presents immense opportunities for both banks and their customers, while also posing significant challenges that must be addressed through strategic investments in technology, security, and customer education.

Figure 2: The evolution of digital banking showcases the rapid advancement from traditional methods to modern digital solutions.

Digital Culture: Fostering a Mindset for Change

A digital culture is the lifeblood of modern organizations and a prerequisite for thriving in a fast-paced, technology-driven world. It involves adopting a mindset that embraces change, values innovation, and encourages continuous learning. In the context of digital banking and broader digital transformation, cultivating a digital culture is essential for sustaining competitive advantage.

At its core, digital culture is about leveraging digital tools and technologies to drive efficiency, collaboration, and creativity. Organizations that foster a digital culture invest in training programs, encourage cross-functional collaboration, and implement agile methodologies that allow for rapid iteration and improvement. This cultural shift is not limited to technology departments; it permeates all levels of the organization, influencing strategic decision-making and everyday operations.

One of the primary benefits of a digital culture is enhanced employee engagement. When employees feel empowered to experiment with new ideas and technologies, they are more likely to contribute innovative solutions that drive business growth. Digital culture also encourages transparency and open communication, breaking down traditional silos and fostering an environment where diverse perspectives are valued.

To build a robust digital culture, organizations must prioritize leadership commitment. Leaders play a crucial role in setting the tone for the organization by modeling digital behaviors and championing change initiatives. When leadership actively supports digital transformation, it sends a clear message to employees that innovation is a strategic priority. This, in turn, creates a sense of urgency and motivation among staff to develop the digital skills necessary for success.

Furthermore, digital culture promotes a customer-centric approach. By utilizing data analytics and digital feedback mechanisms, companies can gain deeper insights into customer preferences and pain points. This information can then be used to tailor products, services, and customer interactions, leading to improved customer satisfaction and loyalty.

However, cultivating a digital culture is not without its challenges. Resistance to change is one of the most common hurdles. Employees who are accustomed to traditional processes may be hesitant to adopt new technologies or change established workflows. Addressing this resistance requires a thoughtful change management strategy that includes clear communication, training, and support. In many cases, organizations may need to realign their reward systems to encourage innovation and digital adoption.

In addition to internal challenges, digital culture must also navigate the external pressures of an increasingly competitive market. As digital trends continue to evolve, organizations must be agile in adapting their strategies to meet emerging customer needs and market demands. This requires a willingness to take calculated risks and experiment with new business models, even in the face of uncertainty.

The benefits of a well-established digital culture are manifold. Companies with a strong digital foundation are better positioned to leverage emerging technologies, drive operational efficiencies, and foster a collaborative work environment that encourages innovation. In a world where change is the only constant, a digital culture is not merely an asset but a strategic imperative that can determine an organization’s long-term success.

Figure 3: A thriving digital culture promotes innovation, collaboration, and continuous learning.

Organizational Learning: The Engine for Continuous Improvement

Organizational learning is the process by which organizations develop, enhance, and transfer knowledge to improve their performance and adapt to new challenges. In the context of digital transformation, organizational learning is indispensable for maintaining a competitive edge. It involves creating an environment where information is continuously gathered, analyzed, and utilized to drive strategic decision-making.

For organizations in the digital banking sector, learning is not a one-time event but an ongoing journey. The rapid pace of technological change requires banks to constantly update their skills and knowledge base. This necessitates structured training programs, mentorship opportunities, and platforms that encourage knowledge sharing among employees. By fostering a culture of learning, organizations can not only keep pace with technological advancements but also anticipate future trends and challenges.

One of the key aspects of organizational learning is the ability to learn from both successes and failures. In a digital environment, experimentation is inevitable, and not every initiative will yield the desired results. However, each failure provides valuable insights that can be used to refine strategies and improve future performance. Organizations that embrace a learning mindset are more resilient, as they view setbacks as opportunities for growth rather than reasons for discouragement.

Moreover, the integration of digital tools into the learning process has revolutionized how knowledge is disseminated within an organization. Virtual training sessions, online courses, and collaborative platforms allow employees to access information anytime and anywhere. This flexibility not only enhances the learning experience but also ensures that employees can stay current with the latest industry developments.

The benefits of organizational learning extend beyond individual skill development. A learning organization is better equipped to respond to external changes, innovate, and maintain high levels of customer satisfaction. In the fast-evolving financial services industry, the ability to quickly adapt to regulatory changes, emerging market trends, and new technological advancements is crucial for sustained success.

However, achieving a high level of organizational learning requires a strategic approach. Leadership must prioritize learning as a core value and allocate resources to support training initiatives. It is also essential to create a safe environment where employees feel comfortable sharing their ideas and learning from one another without fear of punitive consequences. In addition, performance metrics should be aligned with learning objectives to ensure that knowledge acquisition is recognized and rewarded.

Ultimately, organizational learning is the engine that drives continuous improvement and innovation. By embedding learning into the fabric of their culture, organizations can foster agility, improve problem-solving capabilities, and sustain long-term growth. This is particularly important in industries like digital banking, where the ability to adapt and innovate is a key differentiator.

Figure 4: Continuous organizational learning drives improvement, agility, and innovation in the digital era.

Innovation: The Catalyst for Growth and Transformation

Innovation is widely recognized as the catalyst for growth and a critical driver of competitive advantage. In the digital age, innovation is not just about developing new products or services; it is about transforming the entire business model to better meet customer needs and respond to market dynamics. For digital banking institutions, innovation is a means to improve efficiency, reduce costs, and offer personalized financial solutions.

The innovation process in digital banking is fueled by a combination of technological advances and changing customer expectations. With the integration of artificial intelligence, blockchain technology, and big data analytics, banks are able to streamline operations, enhance security, and deliver more tailored services. For instance, chatbots and virtual assistants are increasingly being used to handle customer inquiries, reducing wait times and improving overall customer satisfaction.

Moreover, innovation in digital banking extends to internal processes as well. By adopting agile methodologies, banks can rapidly test and implement new ideas, allowing them to remain responsive to emerging trends. Collaborative innovation environments, where cross-functional teams work together, foster a culture of creativity and experimentation. This approach not only leads to the development of breakthrough products but also encourages a mindset that is open to change and continuous improvement.

In addition to technology-driven innovation, digital banking institutions are increasingly exploring partnerships with fintech startups and technology firms. Such collaborations enable banks to leverage the expertise of agile innovators while providing startups with the stability and resources of established institutions. The resulting synergy has led to the creation of cutting-edge financial products that cater to a rapidly evolving customer base.

However, driving innovation requires overcoming several obstacles. Traditional organizational structures, rigid hierarchies, and resistance to change can stifle creative thinking and slow down the innovation process. To overcome these barriers, companies must embrace an organizational culture that not only tolerates risk but actively encourages experimentation and learning from failure. Leadership plays a crucial role in setting this tone by championing innovative initiatives and providing the necessary resources and support.

Furthermore, innovation is closely tied to effective data management and analytics. In the digital banking arena, the ability to collect, analyze, and interpret vast amounts of data is paramount. Data-driven insights enable banks to identify new market opportunities, optimize their operations, and deliver highly personalized customer experiences. With robust data analytics, organizations can turn information into actionable strategies that drive growth.

In summary, innovation is the lifeblood of digital banking. It transforms challenges into opportunities and enables organizations to stay ahead of the curve. By fostering a culture of creativity, embracing collaboration, and leveraging cutting-edge technologies, digital banking institutions can not only enhance their service offerings but also secure a competitive advantage in a rapidly changing marketplace.

Figure 5: Innovation in digital banking drives growth through technological advancements and creative problem solving.

Employee Performance: Empowerment in a Digital Era

Employee performance is a critical determinant of an organization's success, particularly in an era marked by rapid digital transformation. As banks and other institutions integrate digital technologies into their operations, the role of employees is evolving. No longer are employees simply executing predefined tasks; they are now expected to contribute to innovation, adapt to new digital tools, and drive organizational change.

The shift towards a digitally enabled workplace has a profound impact on employee performance. Digital tools not only streamline routine tasks but also enable employees to focus on more strategic and creative aspects of their work. For example, automation of repetitive processes frees up time for employees to engage in problem-solving, customer engagement, and strategic planning. This enhanced focus on high-value tasks is instrumental in improving overall productivity and job satisfaction.

Empowerment through digitalization also extends to employee training and development. With the advent of online learning platforms and virtual training sessions, employees have greater access to resources that help them upskill and remain relevant in a constantly changing environment. Organizations that invest in continuous learning and professional development create a workforce that is not only competent but also motivated to contribute to the company’s success.

Furthermore, digital performance management systems have transformed how employee performance is monitored and evaluated. These systems provide real-time feedback, set clear performance benchmarks, and offer insights that help employees understand their strengths and areas for improvement. With transparent metrics and data-driven evaluations, employees are more likely to take ownership of their roles and pursue continuous improvement.

Another significant benefit of digital transformation is the improvement in communication and collaboration. Modern digital platforms facilitate seamless communication between employees, regardless of geographical boundaries. This enhanced connectivity fosters teamwork and enables employees to share knowledge and best practices, further contributing to enhanced performance.

However, the digital transformation of employee performance also brings challenges. One of the primary concerns is ensuring that all employees have the digital literacy required to operate new technologies effectively. Organizations must invest in training and support systems to bridge this gap. Additionally, the increased reliance on digital tools necessitates robust cybersecurity measures to protect sensitive employee data.

Leadership and management play a pivotal role in navigating these challenges. By setting clear expectations, providing the necessary resources, and fostering an inclusive digital culture, leaders can empower their teams to excel in a digitally driven environment. When employees feel supported and valued, their performance naturally improves, leading to better outcomes for the organization as a whole.

In the context of digital banking, employee performance is critical for driving innovation and ensuring that customers receive the highest level of service. As banks continue to evolve, the synergy between technology and human capital will determine their long-term success. Ultimately, empowering employees through digital tools and continuous learning is not just a strategy for improved performance—it is a cornerstone for building a resilient and agile organization.

Figure 6: Empowering employees through digital tools and continuous learning drives performance and innovation.

Conclusion

The digital era has ushered in transformative changes across industries, with digital banking at the forefront of this evolution. As explored in this journal, the integration of digital technologies has not only revolutionized the way financial services are delivered but has also catalyzed a broader cultural and organizational transformation. Embracing digital banking is about more than implementing new technologies—it requires a comprehensive shift in mindset, processes, and strategic priorities.

A thriving digital culture is the bedrock upon which innovation and continuous improvement are built. Organizations that foster such a culture empower their employees to take risks, collaborate across silos, and engage in lifelong learning. This, in turn, creates an environment where innovation can flourish, driving sustainable growth and competitive advantage.

Organizational learning is integral to this process. By continuously adapting to technological advancements and market dynamics, companies can remain agile and resilient in the face of change. The lessons learned from both successes and setbacks pave the way for strategic improvements, ensuring that the organization remains at the cutting edge of its industry.

Moreover, the nexus of innovation and employee performance underscores the importance of human capital in the digital age. Technology is a powerful enabler, but it is the creativity, initiative, and expertise of employees that ultimately drive performance. By investing in digital training, fostering an innovative culture, and leveraging data-driven performance management systems, organizations can unlock the full potential of their workforce.

As digital banking continues to evolve, the ability to integrate new technologies with a supportive, forward-thinking organizational culture will be critical. Leaders must recognize that digital transformation is an ongoing journey, one that requires constant adaptation and a commitment to continuous learning. The interplay between digital banking, digital culture, organizational learning, innovation, and employee performance forms a virtuous cycle that can propel organizations to new heights.

In conclusion, the journey towards digital excellence is multifaceted and challenging. It requires a strategic approach that aligns technological advancements with human capital development and a culture of innovation. By embracing these elements, organizations can not only enhance their operational efficiency but also create a dynamic and resilient ecosystem capable of thriving in a rapidly changing world.

Whether you are a leader in the financial sector or a professional navigating the complexities of digital transformation, the insights presented in this journal offer a roadmap for success. By investing in digital banking, fostering a progressive digital culture, promoting organizational learning, driving innovation, and empowering employees, organizations can chart a path toward sustainable growth and long-term success.

The future of banking and business is undeniably digital. Those who recognize and act on this reality will not only survive but will thrive in an era where agility, innovation, and performance are the keys to success.

Figure 7: Embracing digital transformation leads to a sustainable future in banking and beyond.

Final Thoughts

The integration of digital banking, digital culture, organizational learning, innovation, and employee performance creates a comprehensive framework that supports the evolution of modern organizations. Each element reinforces the others, creating a synergistic effect that drives success and competitive advantage. As technology continues to advance and reshape the business landscape, companies must remain agile, continuously learning, and open to innovative ideas.

By leveraging the power of digital tools, fostering an environment of continuous improvement, and empowering employees to excel, organizations can effectively navigate the challenges of the digital era. This holistic approach not only enhances operational efficiency but also builds a strong foundation for sustainable growth and long-term success.

The transformation is ongoing and demands that businesses remain vigilant and proactive. Future developments in technology and evolving customer expectations will require organizations to continuously adapt and innovate. The insights provided in this journal serve as a call to action for leaders to invest in digital transformation strategies that support both technological advancements and human capital development.

Ultimately, the journey towards digital excellence is one that demands courage, commitment, and a willingness to embrace change. The rewards, however, are immense—ranging from improved customer experiences and operational efficiencies to enhanced employee engagement and sustained competitive advantage.

As you embark on or continue your digital transformation journey, remember that the future is shaped by those who dare to innovate, learn continuously, and empower their teams. Embrace the challenges and opportunities that come with digital transformation, and lead your organization into a future defined by agility, innovation, and excellence.

Comments

Post a Comment